Is Southern Oregon’s Housing Market Really Crashing? Here’s the Truth

Hi, I’m Brian Simmons with the Buying Southern Oregon real estate team. In this article I’m going to walk you through exactly what I mean when I say that the national headlines about a housing market crash in Oregon don’t tell the whole story — and why people who are waiting for a dramatic collapse may be making a costly mistake. If you’ve been reading doom-and-gloom articles, you’ve probably seen the headline phrase “Housing Market Crash in Oregon” thrown around as if it described every neighborhood, town, and county. It doesn’t. In this piece I’ll break down local sales volume, median price behavior, inventory trends, mortgage-rate dynamics, and the real driver behind what’s happening here in Southern Oregon.

Table of Contents

- This Will Be Worse Than A Housing Market Crash in Oregon

- Oregon Home Sales Volume

- Market Increase

- Median Sale Price

- Inventory

- Mortgage Average

- Consistent Demand

- What This Means for Buyers, Sellers, and Investors

- FAQs About The Housing Market Crash in Oregon

- Conclusion: Don’t Let a Headline—Or Waiting—Rob You of Opportunity

This Will Be Worse Than A Housing Market Crash in Oregon

The headline “This Will Be Worse Than a Housing Market Crash in Oregon” grabs attention — and maybe even stokes fear. I used that phrasing deliberately: not to suggest Southern Oregon is about to experience a 2008-style freefall, but to provoke a reality check. National news often reduces a complex national ecosystem into a single terrifying narrative. That narrative usually becomes prices collapsing, days on market skyrocketing, buyers sitting on the sidelines forever. But that’s not how real estate works in practice. Real estate is local. Saying “Housing Market Crash in Oregon” as a blanket label ignores the neighborhoods, counties, buyer profiles, and supply dynamics that actually determine outcomes.

Let me be blunt: Southern Oregon is not the same as New York, Los Angeles, Miami, or Houston. Each of those markets has its own drivers — big institutional investors, large-scale new construction, and local economic shocks — that can produce big swings. Southern Oregon’s story is different. We’ve seen changes, yes, but not a collapse. If you're worried because you saw the phrase "Housing Market Crash in Oregon" in a headline, keep reading. I’ll unpack the data and explain why the picture here is much more nuanced.

Oregon Home Sales Volume

Sales volume tells a story that is far more nuanced than “boom” or “bust.” Let’s look at Q2 — the second quarter — which historically is the busiest real estate quarter of the year. For Jackson and Josephine (Jess) counties, Q2 is the quarter I watch closely. Here’s what we saw:

- Q2 2021: roughly $618 million in volume (mortgage rates ~3%)

- Q2 2022: roughly $650 million in volume (rates ~5.2%)

- Q2 2023: $423 million in volume (rates ~6.5% and rising)

- Q2 2024: $447 million in volume (rates ~7%)

- Q2 2025: $491 million in volume (rates ~6.8%)

There are two truths here that can be spun in opposite directions. If you want doom and gloom, you say “sales volume down significantly from the highs of 2021–2022.” That’s technically true. If you want a more accurate assessment, you say “volume is up significantly from 2023 lows, and has shown steady improvement even with rates still elevated.” That is also true.

Why does this matter? Because when rates jump, activity cools. When rates stay elevated, buyers adjust, inventory shifts, and markets re-balance. What we did not see in Southern Oregon was a flood of distress sales or a meltdown of demand. Instead, from 2023 to 2025 we saw a nearly $50 million increase in Q2 sales volume — even with mortgage rates in the mid-to-high 6% range. That climb is a sign of resilience, not collapse. It means buyers adapted to higher rates, priced homes adjusted, and transactions resumed.

Market Increase

“Market increase” might sound like a vague term, but what I mean here is the combination of volume recovery and the stabilization of prices. The market increase from 2023 through 2025 hasn’t been a return to the 2021–2022 frenzy, but it’s steady improvement. Buyers who stepped to the market in 2024 and 2025 were not the same panic-driven shoppers who were bidding every house to multiple offers in 2021. They were more measured, more rate-sensitive, and often more selective. That’s healthy.

One of the best ways to understand whether a market is healthy is to examine whether the improvement is driven by a one-time surge (like a flood of cheap listings or government incentives) or by sustained, balanced demand. Our local improvement has been steady, measured, and not fuelled by panic. That tells me the increase is sustainable — not speculative hype. That’s important for anyone concerned about a “housing market crash in Oregon.” A crash requires a widespread structural failure — mass defaults, huge overbuilding, or a sudden demand shock. We don’t have any of that here.

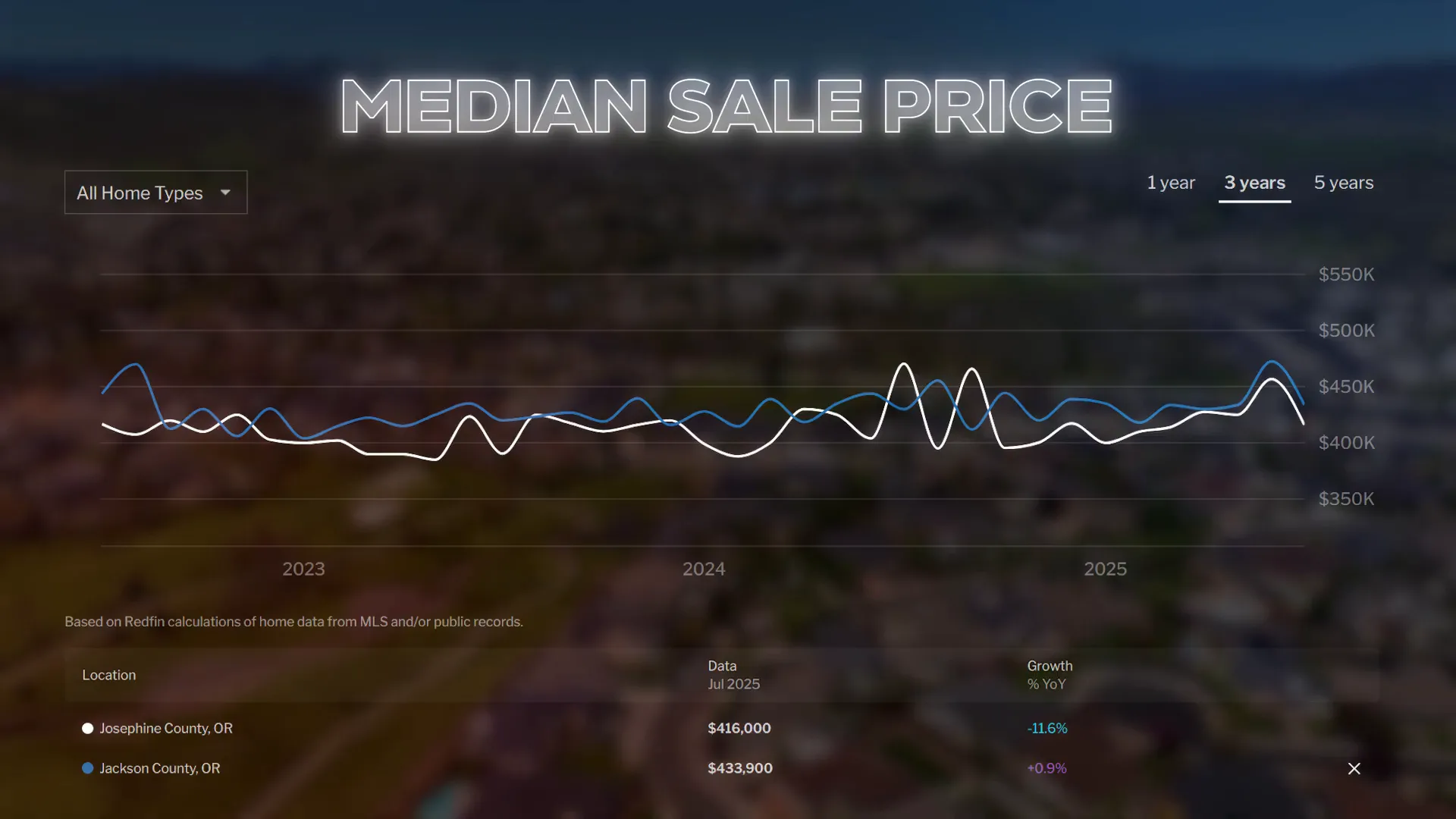

Median Sale Price

Prices are another key piece of the puzzle. Looking at median sale price for single-family homes in Jackson and Josephine counties helps illustrate the reality that values have been far more stable than headlines suggest.

Here’s the longer view:

- February 2018 median: $275,000 — taken as a pre-runup baseline

- February 2022 median: $440,000 — about a 60% rise over 4 years

- 2023–2025 median: hovering roughly $440,000–$450,000

That price behavior is telling. Values jumped between 2018 and 2022, following the wave that hit much of the country. But since 2022, median prices have largely held steady — neither collapsing nor exploding. That stability is exactly the opposite of what you’d see in a crash scenario. During a true crash, median prices would fall rapidly as distressed sellers flood the market and buyers withdraw. We haven’t seen that here.

That stability, however, masks important internal segmentation. Some asset types and locations did soften a bit: remote rural parcels, hard-to-sell fixer-uppers, and properties with unique issues can take a hit. On the other hand, new construction and well-located single-family homes have retained or even gained value. When you hear the phrase “housing market crash in Oregon,” remember that averages hide important splits. Not every segment behaves the same.

Inventory

Inventory — measured as months of supply — is one of the most important metrics to understand whether a market favors buyers or sellers. It’s a straightforward metric: how long would current inventory take to sell at the current sales pace?

Here’s how inventory played out in Southern Oregon:

- July 2022: 3.4 months of inventory

- July 2025: 4.6 months of inventory

- January 2008 (for perspective): 22 months of inventory

We moved from roughly 3.4 months to 4.6 months — a tick up, but not a tsunami. In practical terms, 3–4 months of inventory is typically considered a balanced to modestly seller-favored market; 4–6 months is balanced. So the shift we saw was simply a return to a more natural balance after a very tight period. It is not a sign of distressed sellers overwhelming the market like during the Great Recession.

That 2008 comparison is instructive because it helps define what a true crash looks like. Back then, a confluence of risky lending, speculative building, and a massive employment shock created a prolonged buyers’ market with years of high inventory and falling prices. Southern Oregon’s current 4.6 months does not match that pattern. The market is adjusting, not imploding.

Mortgage Average

Here’s the reality most people already sense but don’t always name: mortgage rates are the throttle for the housing market. Low rates = acceleration. High rates = braking. Since 2022, hopes for rate cuts have been persistent. Everyone expected rates to drop fast — whether motivated by politics, economic forecasting, or inflation trends. Yet mortgage rates lingered in the mid-6% range for longer than many anticipated.

If you’re one of the people waiting for a crash so you can buy at the bottom, or waiting for rates to drop so you can afford more, ask yourself: what happens if rates in the 6–7% window are the “new normal” for a while? In that case, the worst thing is not a crash; it’s wasted time. Years of sitting on the sidelines waiting for a rate or price event that never comes can mean you miss opportunities to build equity, secure a home, or relocate to a place you love.

So what does mid-6% mean in practice? It means fewer frenzied bidding wars and more careful buyer decisions. It means prices can stay stable because buyers and sellers adapt. It means gradual increases in sales volume as buyers adjust to rate-sensitive budgets. In a healthy, balanced market, that’s not “worse than a crash” — it’s maturation.

Consistent Demand

Southern Oregon’s demand profile is unique and important to understand. We’re a desirable region for a host of reasons: lower cost of living relative to big West Coast metros, excellent outdoor recreation, good medical care, favorable climate, and proximity to larger West Coast cities without the daily congestion. That appeal generates consistent inbound demand from people relocating for lifestyle reasons, remote workers seeking better quality of life, and retirees looking for affordability and amenities.

Another structural advantage for Southern Oregon is scale. We aren’t big enough to attract the massive national builders who flood other markets with cookie-cutter subdivisions and volume that can depress local pricing. That doesn’t mean we have no new builds — we do — but we’re not seeing huge overbuilding that would overwhelm demand. That structural constraint helps maintain a healthier balance of supply and demand and supports price stability.

Put simply: demand is steady, supply is constrained in ways that prevent severe oversupply, and price movement responds accordingly. Combine steady demand with modest inventory and stable mortgage rates, and you get a market that evolves rather than collapses. If your mental image of a “Housing Market Crash in Oregon” is a repeat of 2008, that’s not what’s happening here.

What This Means for Buyers, Sellers, and Investors

If you’re trying to decide whether to buy, sell, or invest, here’s how to think about it with the Southern Oregon data in mind:

- Buyers: Don’t wait forever for a crash that may never come. Consider your timeline, financing options, and the lifestyle benefits of owning. If you’re relocating, buying sooner can mean locking in a home while you start building roots.

- Sellers: While the frenzy of 2021–2022 has passed, you are still likely to find a balanced market. Pricing your home appropriately and staging it for the current buyer will yield results — you don’t need a dramatic market spike to sell successfully.

- Investors: Look for local fundamentals. Stable prices, consistent demand from relocators, and lack of massive overbuilding create opportunities for long-term holds and buy-and-hold strategies. Short-term flips that rely on rapid appreciation are riskier in a stable-to-gradual market.

FAQs About The Housing Market Crash in Oregon

Is a housing market crash in Oregon inevitable?

No, a crash is not inevitable — especially not across every community in Oregon. Crashes occur when there is a widespread imbalance caused by things like mass foreclosures, reckless lending, or huge oversupply. Southern Oregon has not shown those signs. Instead, we’ve seen steady demand and stable prices. Still, markets can change, so local data and professional advice matter.

Will mortgage rates drop soon and cause a new buying frenzy?

Predicting short-term rate moves is tricky. Rates are influenced by the Fed, inflation trends, global economic conditions, and market sentiment. If rates fall a lot, we could see increased activity. But my working assumption is that rates in the 6%–7% range could persist for some time, which would support continued steady activity rather than a sudden frenzy.

What should I do if I’m waiting to buy until prices fall?

Waiting for a big price collapse can backfire, particularly in a market that is stabilizing. Consider your personal financial readiness, how long you plan to hold property, and the cost of waiting (rent, missed equity growth, lost lifestyle benefits). If your horizon is long-term, modest price stability or gradual increases are not the worst environments to buy in.

Could a local shock create a crash in Southern Oregon?

Local shocks (major employers leaving, natural disasters, or sudden policy changes) can impact localized markets. However, we have not seen systemic triggers here like those that caused 2008. Still, always consider diversification and mitigation strategies if investing heavily in any single local market.

How can I get more data about this market?

If you want deeper, local-specific data — neighborhood-level trends, days on market, price-per-square-foot by subdivision — I have a relocation guide and market reports that go much deeper. Reach out to me directly and I’ll share the resources that fit your needs.

Conclusion: Don’t Let a Headline—Or Waiting—Rob You of Opportunity

Headlines that scream “housing market crash in Oregon” sell clicks, but they rarely tell the whole story. Real estate is local and nuanced. Southern Oregon’s data through 2025 shows resilience: steady increases in sales volume since 2023, median prices that have stabilized rather than collapsed, modest inventory increases that move us toward balance rather than oversupply, and mortgage rates that act as the throttle on activity rather than the ignition of a crash.

If you’re sitting on the sidelines waiting for a market event that might not materialize, you could be trading time and opportunity for a hypothetical bottom. If Southern Oregon’s lifestyle, affordability, and long-term demand align with your goals, there are real reasons to consider acting now rather than waiting for a “housing market crash in Oregon” that never comes.

I’m not here to sugarcoat things. I’m here to give you honest, local insight. If you want more granular data about Jackson or Josephine counties, neighborhood-level trends, or help deciding whether to buy, sell, or invest, reach out — call, text, or email. I’ll walk you through the local realities and help you make a decision aligned with your goals.

Buying Southern Oregon

At Buying Southern Oregon, we are a dynamic team dedicated to helping you achieve your real estate goals. Combining Brian Simmons’ deep market expertise and Josh Berman’s strong negotiation skills, we provide personalized service and local knowledge to ensure a seamless and rewarding experience. Whether you’re buying, selling, or relocating, we’re here to guide you every step of the way and make your Southern Oregon real estate journey a success.